Charter Hall Social Infrastructure REIT (ASX:CQE)

Our Property Portfolio

Charter Hall Social Infrastructure REIT (ASX:CQE) is the largest Australian ASX listed real estate investment trust (A-REIT) that invests in social infrastructure properties.

These properties are vital in delivering essential community services to Australians and can include childcare centres and education facilities, health and transport assets and government services (e.g. justice and emergency facilities).

$2.1bn

Portfolio Valuation

100%

Occupancy

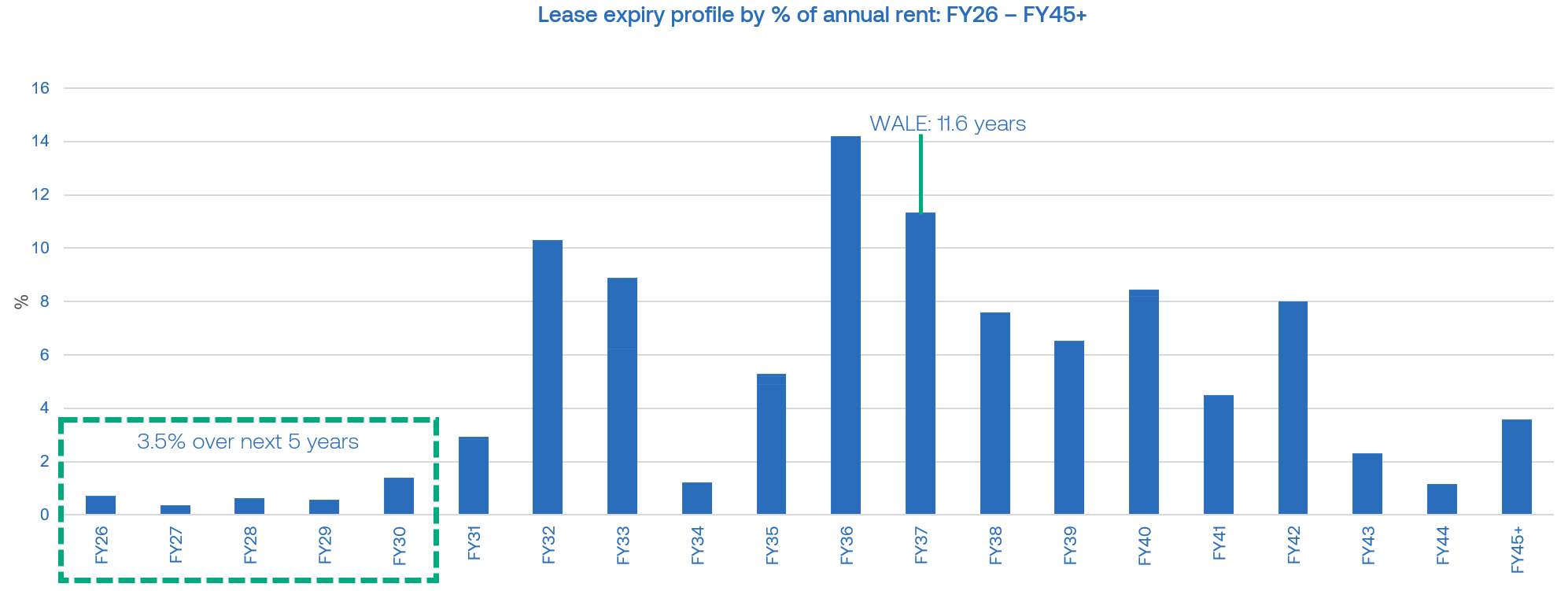

11.6 years

WALE

3.5%

Lease income expiring <5 years

Tour a selection of our Social Infrastructure assets

TAFE Robina, QLD

Nido Early School, Coburg North, VIC

Emergency Command Centre, SA

Only About Children, Balwyn North, VIC

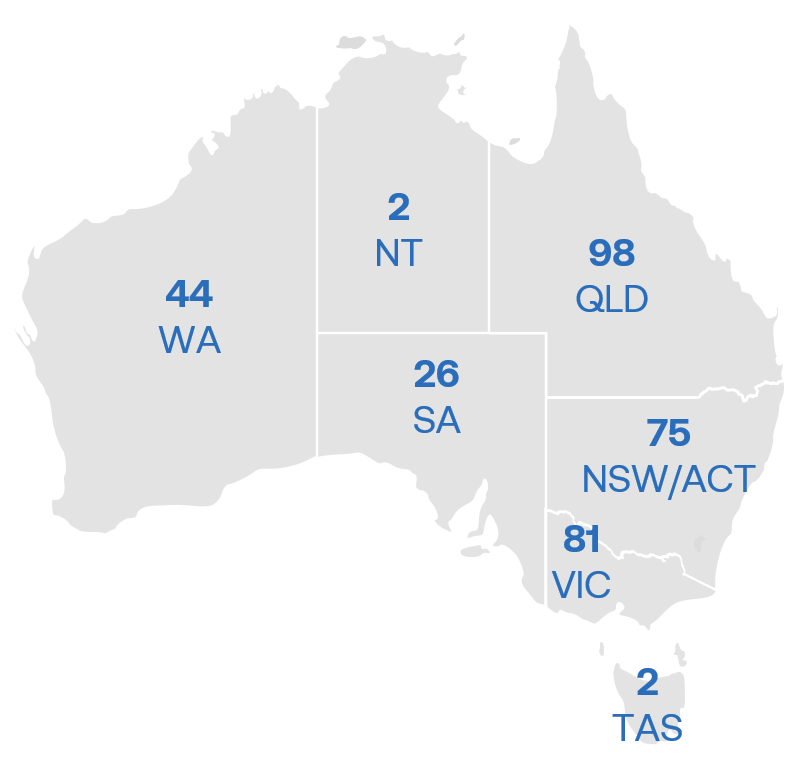

State Diversification

As at 30 June 2025

- Diversified social infrastructure portfolio of 328 properties with sector leading tenants providing essential services.

- Land rich portfolio of 104 hectares of land with future alternative uses with 73% located in metropolitan areas

Portfolio WALE remains strong at 11.6 years

- Only 3.5% of lease income expiring within the next 5 years (only 1.9% without further options)

- Typical notice periods of 3 – 5 years from expiry

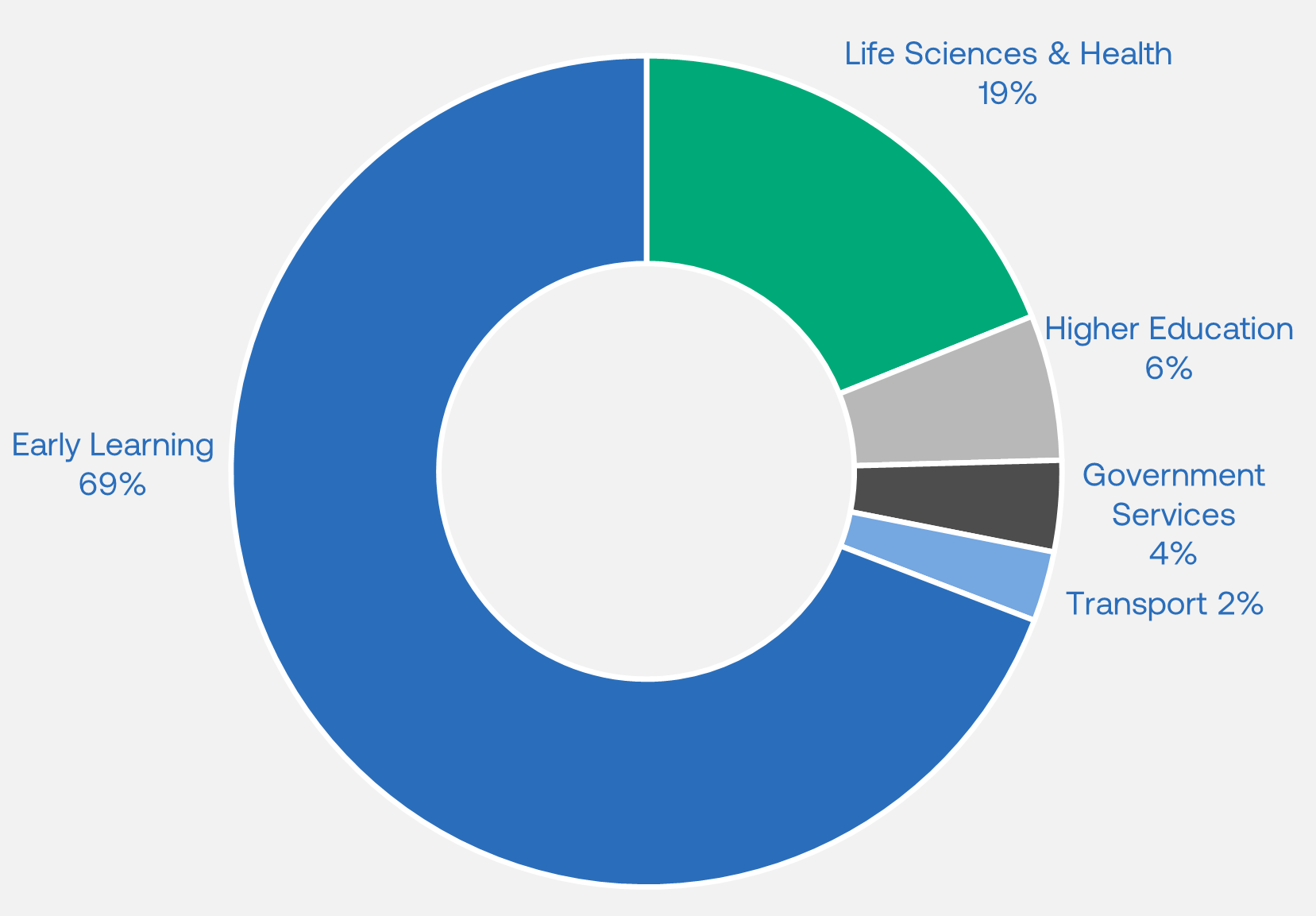

Sector Diversification

- Targeting growing sectors providing essential services underpinned by Government support

- Greater sector diversification enhances income sustainability and resilience

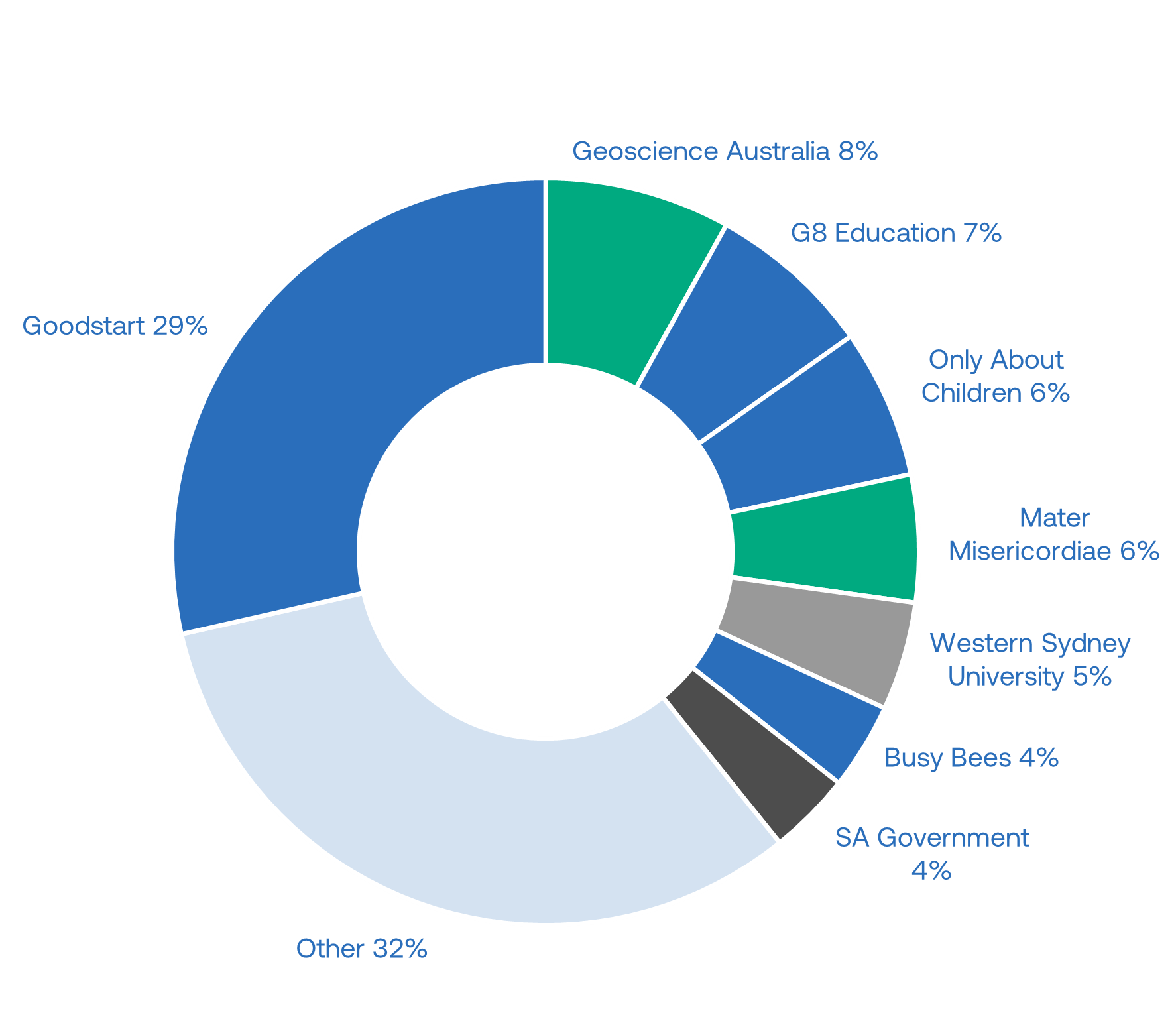

Tenant profile by % of income as at 30 June 2025

- Focused on improving tenant quality with properties leased to sector leading corporate and Government tenants

- Sector leading corporate and Government tenants providing essential services and social impact

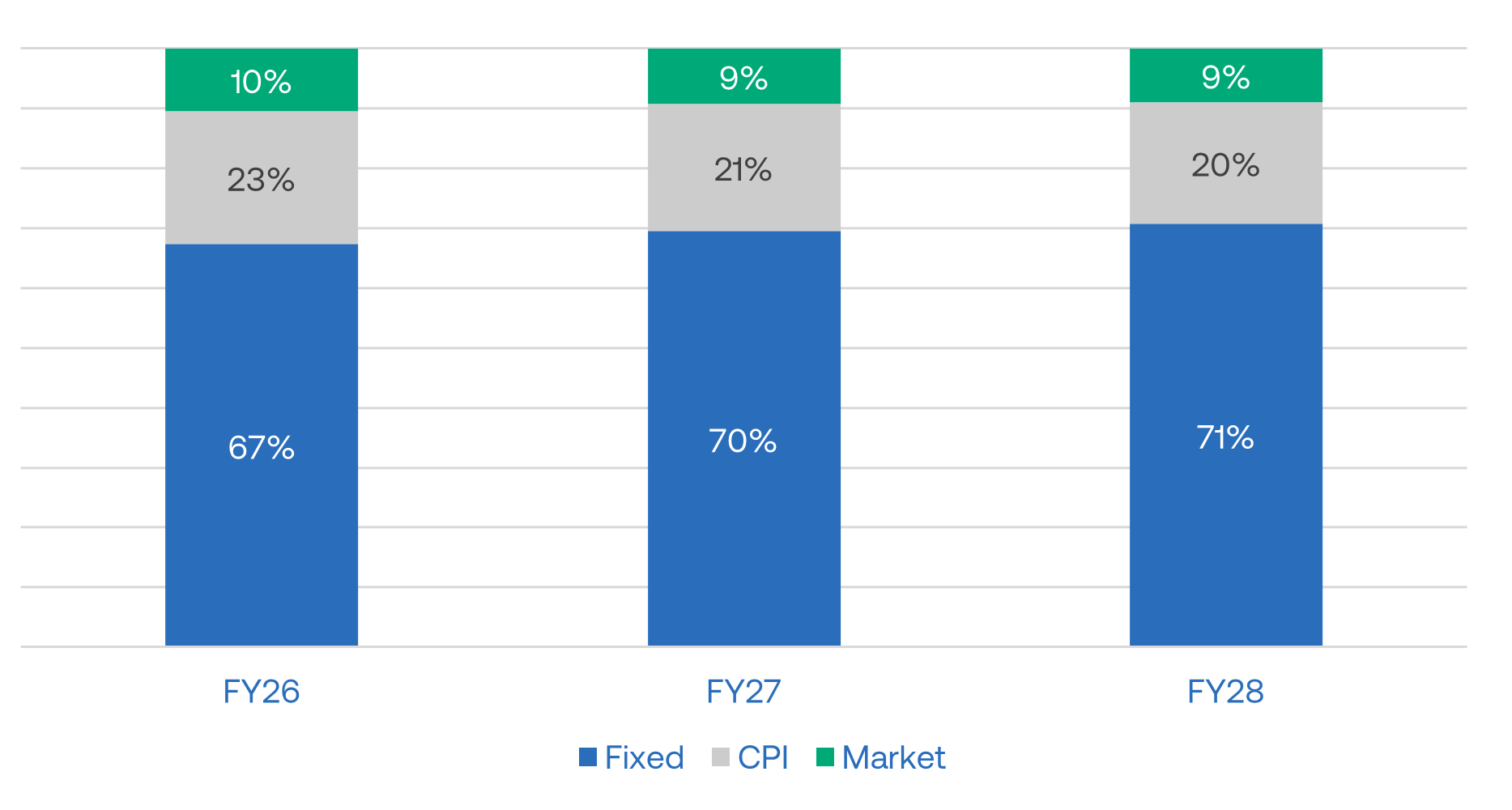

Strong rental growth potential with 28% of income subject to market reviews in next 3 years

- 69 market reviews completed in FY25 achieving uplift of 10.5%

- 19 uncapped reviews achieving 17.7% uplift ($0.9 million)

- 50 capped reviews achieving 6.7% uplift ($0.7 million)

- 149 early learning centre market rent reviews (28% of CQE’s total income) in the next 3 years

Important Information

Charter Hall Social Infrastructure Limited ACN 111 338 937; AFSL 281544 (“CHSIL”) has issued this information in its capacity as the responsible entity of Charter Hall Social Infrastructure REIT ARSN 102 955 939 (“CQE"). This information has been prepared for general information purposes only and is not an offer or invitation for subscription or purchase of, or recommendation of, securities. It does not take into account any potential investors’ personal objectives, financial situation or needs. Before investing, you should consider your own objectives, financial situation and needs or you should obtain financial, legal and/or taxation advice. For more details on fees, see CQE’s latest annual report. The information has been prepared by CQE in good faith. No representation or warranty, express or implied, is made as to the accuracy, adequacy, reliability or completeness of any statements, estimates, opinions or other information contained in this presentation, any of which may change without notice. This includes, without limitation, any historical financial information and any estimates and projections and other financial information derived from them (including any forward-looking statement). Nothing contained in this information is, or may be relied upon, as a promise or representation, whether as to the past or the future. To the maximum extent permitted by law, CQE (including its respective unitholders, shareholders, directors, officers, employees, affiliates and advisers) disclaim and exclude all liability for any loss or damage suffered or incurred by any person as a result of their reliance on the information contained in this presentation or any errors in or omissions from this presentation. This presentation contains information as to past performance of CQE. Such information is given for illustrative purposes only, and is not – and should not be relied upon as – an indication of future performance of CQE. The historical information is, or is based upon, information contained in previous announcements made by CQE to the market. These announcements are available at www.asx.com.au. This information contains certain “forward looking statements”. Forward looking words such as “expect”, “should”, “could”, “may”, “will”, “believe”, “forecast”, “estimate” and other similar expressions are intended to identify forward-looking statements. Such statements are subject to various known and unknown risks, uncertainties and other factors that are in some cases beyond CQE’s control. These risks, uncertainties and factors may cause actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements and from past results, performance or achievements. CQE cannot give any assurance or guarantee that the assumptions upon which management based its forward-looking statements will prove to be correct or exhaustive beyond the date of its making, or that CQE’s business and operations will not be affected by other factors not currently foreseeable by management or beyond its control. Such forward-looking statements only speak as at the date of this announcement and CQE assumes no obligation to update such information. All information contained herein is current as at 31 December 2025 unless otherwise stated. All references to dollars ($) are to Australian dollars, unless otherwise stated.